s corp tax calculator nyc

Annual state LLC S-Corp registration fees. Photo by Dimitry Anikin.

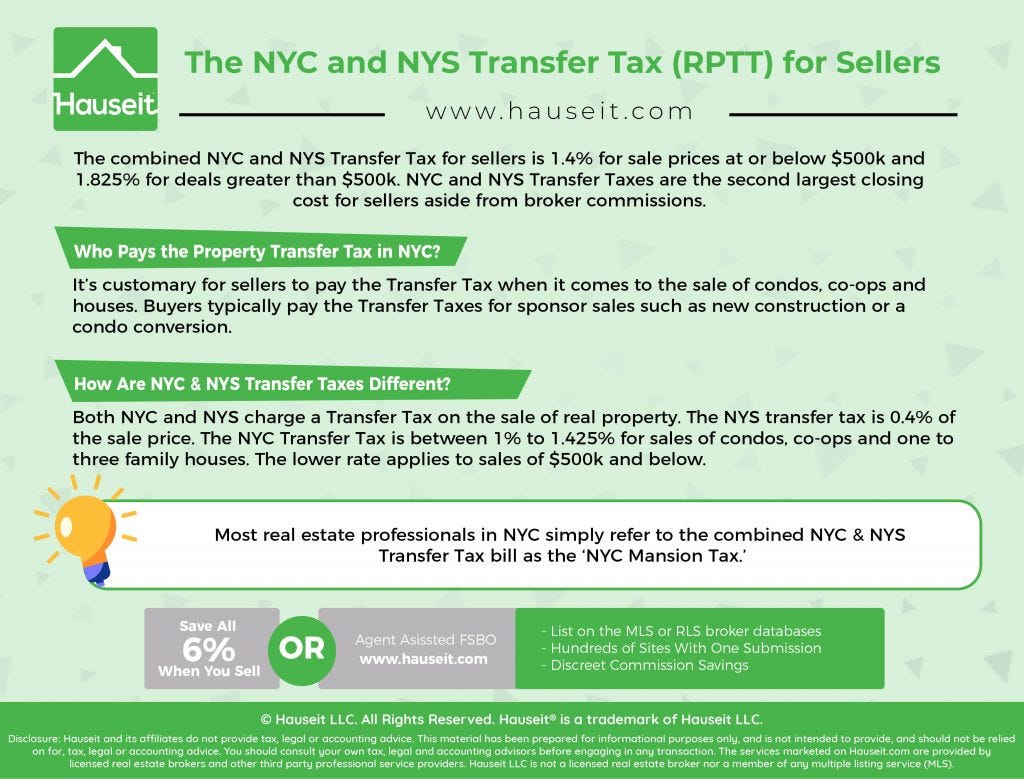

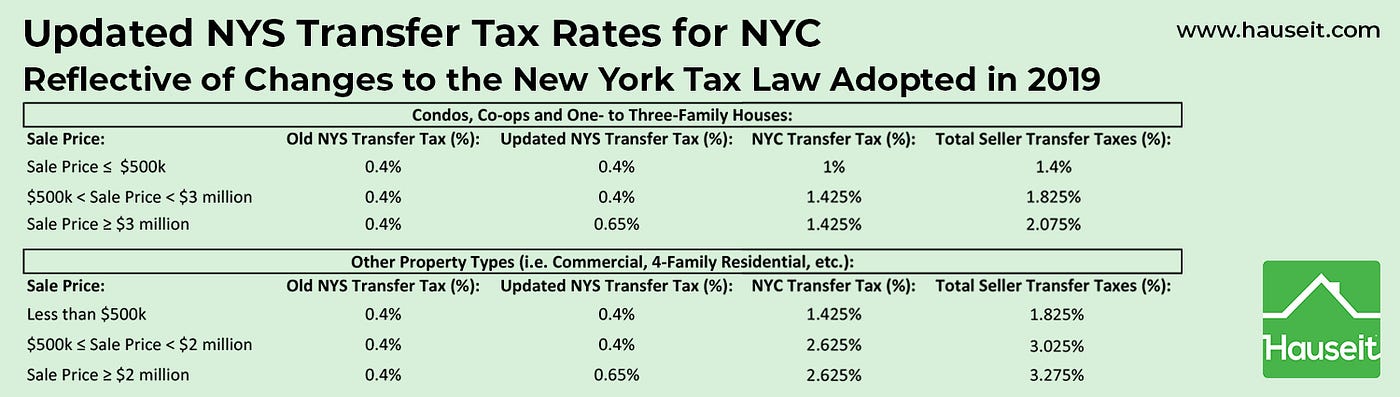

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

For example if you have a business that earns 200 in revenue and has 75 in expenses then your taxable income is 125.

. Now if 50 of those 75 in expenses was related to meals and. All other corporations 15. New York Estate Tax.

Dormant S corporations which did not engage in any business activity or hold title. Forming an S-corporation can help save taxes. Annual cost of administering a payroll.

These corporations will continue to file GCT tax returns in tax years beginning on or after January 1 2015 if they are. New York Estate Tax. S-Corp or LLC making 2553 election.

Total first year cost of. The portion of total business capital directly attributable to stock in a subsidiary that is taxable as a utility within the meaning of the New York City Utility Tax or would have been taxable as an insurance corporation under the former New. This could potentially increase the S-corp tax bill significantly and essentially wipe out the other tax advantages offered by this entity structure.

However one major difference from c corporations is that the new york city s corporation tax rate is a flat 885as opposed to a range of 65 to 885. Effective for tax years beginning on or after January 1 2015 the general corporation tax GCT only applies to subchapter S corporations and qualified subchapter S subsidiaries under the US. When taxing capital the rate is 015 with a cap payment of 1 million.

9 hours agoMay 16 2022 7 min. C-Corp or LLC making 8832 election. Forming an S-corporation can help save taxes.

From the authors of Limited Liability Companies for Dummies. The exemption for the 2021 tax year is 593 million which means that any. See S corporations - tax years beginning before January 1 2015 for S corporation information for years prior to corporate tax reform.

This is why it is imperative for those considering an S-corp to be. This calculator helps you estimate your potential savings. Another way that corporations can be taxed is directly on their business capital less certain liabilities.

How s corporations help save money. Annual state LLC S-Corp registration fees. S corp tax calculator nyc Thursday February 10 2022 Edit.

We are not the biggest firm but we will work with you hand-in-hand. If you are a qualifying manufacturer you will have a cap of 350000. See TSB-M-15 7C 6I for additional information on the impact of corporate tax reform on New York S corporations and their shareholders.

For example in New York City an S-corp would be subject to the citys 885 business tax on top of state and federal taxes. Not more than 100000. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses.

Smaller businesses with less net income will only have to pay 65. Estimated Local Business tax. Partnership Sole Proprietorship LLC.

It doesnt have to be this way. Cooperative housing corporations 04. Check each option youd like to calculate for.

If your company is taxed at a high level try our S Corp tax savings calculator. You can also use our New York property tax calculator to find out what you would pay in property taxes in New York. Now if 50 of those 75 in expenses was related to meals and.

If your shareholders have made an S election for federal purposes you. New Yorks estate tax is based on a graduated rate scale with tax rates increasing from 5 to 16 as the value of the estate grows. Rate in Tax Year 2015 and thereafter.

New York City Taxes A Quick Primer For Businesses

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

A Frozen Bank Account Is A Bank Account That You Cannot Access Because A Creditor Has Placed A Restraint On Student Information Credit Card Online Bank Account

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

The Nyc And Nys Transfer Tax Rptt For Sellers By Hauseit Medium

New York City Taxes A Quick Primer For Businesses

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

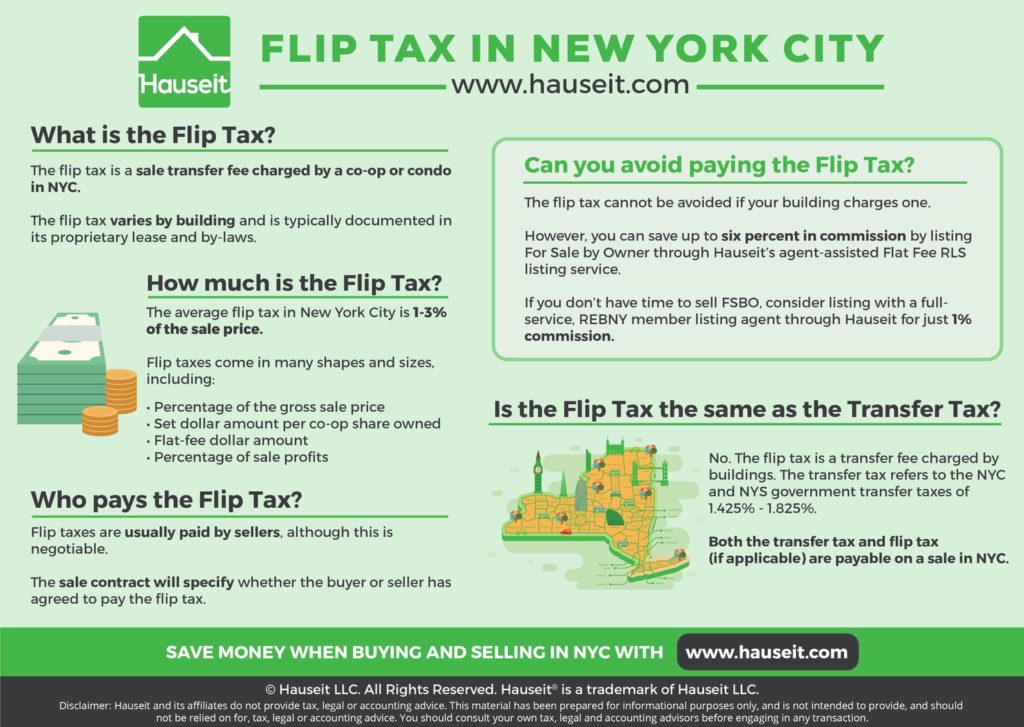

What Is The Average Co Op Flip Tax In Nyc And Who Pays It By Hauseit Medium

Ny State And City Payment Frequently Asked Questions

The Nyc And Nys Transfer Tax Rptt For Sellers By Hauseit Medium

What Is The Average Co Op Flip Tax In Nyc And Who Pays It By Hauseit Medium

The Best Working Tax Credit Number This Was The Best Support Number We Could Find For The Working Tax Credit Customer Service Work Tax Credits Tax Credits

Right Of First Refusal Work In Nyc Hauseit Right Of First Refusal Buying A Condo Nyc

Flip Tax In New York Real Estate Who Pays Them

New York State Enacts Tax Increases In Budget Grant Thornton

Office Of Payroll Administration

Flip Tax In Nyc What Is The Average Flip Tax And Who Pays It Hauseit

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit